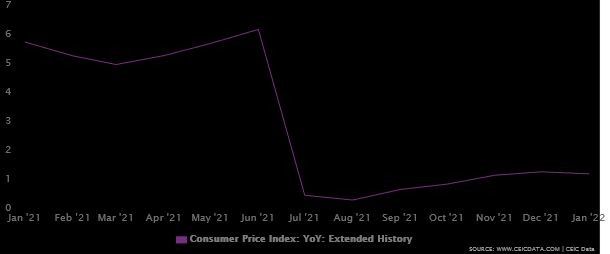

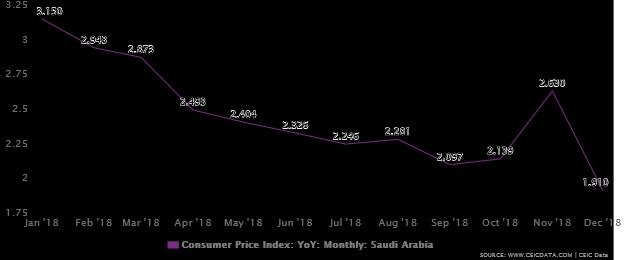

Inflation rate of consumer goods for the years; 2018 and 2021 monthly

Introduction

Inflation is a continuous increase in the price of goods and services in the economy. It is accompanied by a loss of purchasing power in the economy. Additional cash units are required to purchase the same amount of goods and services as a result. Your money buys you a little, be it bread, toothpaste, rent, or medical supplies. many countries have high inflation - and in some cases inflation, 1,000 percent or more per year. In 2008, Zimbabwe experienced one of the worst cases of hyperinflation in its history, with an estimated 500 billion annual inflation. Such inflation has caused great damage, so countries must take drastic measures to restore inflation to normal levels, sometimes at the expense of giving up their currency which happened in a country like Zimbabwe.

long-lasting episodes of immoderate inflation are often the result of lax financial coverage. If the coins deliver grow too huge relative to the dimensions of a monetary system, the unit fee of the overseas cash diminishes; in extraordinary terms, its buying electricity falls, and expenses rise. Policymakers have to find out the right stability between boosting demand and increasing when desired without overstimulating the financial system and inflicting inflation.

If human beings or agencies anticipate higher fees, they construct the one's expectations into wage negotiations and contractual charge adjustments (inclusive of an automatic lease will increase). This behaviour partially determines the following length's inflation; as soon because the contracts are exercised and wages or fees upward push as agreed, expectations turn out to be self-fulfilling.

Thesis-statement

The kingdom of Saudia Arabia has a very stable inflation rate but due to the pandemic, the inflation rate of the country has been fluctuating. Compare the two years one before the pandemic and one at the time of the pandemic will show how has it affected the country's CPI.

The two years being used for the comparison of the inflation rate are 2018 and 2021.

Methodology

The results of the inflation rates for the year 2018 and 2021 has been found using the consumer index price of the consumer goods widely used in the kingdom of Saudia Arabia. the CPI was recorded by the statistics department of the kingdom of Saudia Arabia. Data from Consumer Price Index

The CPI information of the kingdom of Saudi Arabia has become collected from the website of the overall Authority for data (Gstat), Saudi Arabia. The CPI statistics were taken month-to-month for the length with 15 realizations. The series of CPI has an amazing style for the expected length. The MS- Excel 2010 and E-view 10 software application become used to assemble the prediction model.

Holt’s Linear fashion technique

If the time series contains a fashionable fashion, then a smooth exponential smoothing is beside the point, because its predictions lag inside the lower back of the actual diploma of the series. If the fashion is extremely good, then the forecast of the easy exponential smoothing is generally very low and if the trend is terrible, its forecast is generally very immoderate. The Holt approach corrects the hassle by way of the usage of estimating each the present-day stage of the series and the contemporary charge of a fashion increase or decline at every length. Predictions are realized (through the Holt technique) through fashion mapping anticipated the usage of the modern-day degree as a place to begin (Chatfield, 2000). Holt's two-parameter model is a not unusual version for smoothing and prediction primarily based mostly on style. Holt's version includes 3 separate equations that paintings together to generate a very last prediction of the values.

The CPI calculated thru this approach is used to find the inflation charges for both the years 2018 and 2021. because of this, we will have a look at the outcomes of each year.

Results; Imflation rate in Januray of 2018 and 2021

The inflation rate recorded in January in the year 2018 was 3.2. Saudi Arabia's consumer price index rose 1.2% in January from 12 months earlier, fueled by the aid of better delivery prices,

transport fees elevated by 4.9%, mainly due to the upward push in gasoline charges by 34.5%.

Delivery charges have been the primary driving force of the inflation fee in January 2022 due to their high relative importance within the Saudi client basket bringing up the segment's 13% CPI weight in the inflation basket.

however, in 2021 the inflation price was modified to five.7%. The fee-of-living index for January rose to 104 elements in step with the bottom twelve months of 2018. The patron rate index (CPI) upward thrust changed into specifically driven via way of a surge of 12.3 % 12 months-on-3 hundred and 65days (YoY) in the common charges of food and liquids, stricken by a growth of 12.6% in meals costs. It became located thru a 9.6% upward thrust within the delivery vicinity as automobile expenses grew with the aid of using 11.1%. The telecommunication location recorded a fine upward thrust of 13.8%, affected by a 16.3% boom in the cellular telephone and fax services fees. in the intervening time, the training sector declined by 9.8% because the pre-number one and number one schooling dropped by 14.2%, even as intermediate and secondary education fell with the aid of 12.2%. The housing, water, strength, gas, and fuel zone have become moreover 0.9% down, due to a 1.7% decline in actual housing rents

Inflation rate in Febuay of 2018 and 2021

The inflation rate of consumer goods in February 2018 was recorded to be 2.9 % in the kingdom of Saudi Arabia. Saudi Arabia’s consumer price index rose 1.2% in February from a year earlier, boosted by food price hikes, while prices dropped for other items as the coronavirus outbreak started to impact consumer spending. The overall index posted the third consecutive month of positive inflation in February and was the highest since December 2018. On a month-on-month basis, however, prices increased only 0.3%. Hikes in prices for food, beverages, and transport contributed the most to the annual index increase. Food prices rose 3.6% in February. But a drop in prices for categories such as “restaurants and hotels” as well as “recreation and culture”, which were instead among the main booster of the index in January, when the coronavirus outbreak had still not significantly impacted the Gulf region.

The inflation rate in February 2021 was recorded to be an estimated 5.2 %. February’s print reflected falling prices for housing and utilities, and clothing and footwear. In February, inflation fell to 5.3%. Elevated inflation in recent months has been due to the increase in the value-added tax rate from 5% to 15% back in July 2020. Meanwhile, annual average inflation increased to 4.2% in February.

Inflation rate in March of 2018 and 2021

The inflation rate in march 2018 was recorded to be 2.9%. Consumer prices fell 0.2% from the previous month in March, contrasting February's 0.1% increase. The decline largely reflected lower prices for food and beverages and housing, water, electricity, and gas. Inflation softened to 2.8% in March. The annual average variation in consumer prices rose from minus 0.3% in February to zero in March.

In 2021, the inflation rate in the month of the march reached 4.9%. however, this was greater than that recorded in the same month in the year 2018. This was due to the increase in the consumer price index (CPI) which was mainly driven by a rise of 10.2% year-on-year (YoY) in the average prices of food and beverages and a 10.5% increase in the transport sector, as vehicle prices grew by 9.6%. Telecommunications and tobacco sectors rose by 13.2% and 13.1%, respectively, as the former was impacted by a 15.4% growth in phone and fax service prices, and the latter was affected by a 13.8% increase in cigarette prices. Meanwhile, the education sector declined by 9.5% as the pre-primary and primary education dropped by 14%, while intermediate and secondary education fell by 12.2%. The housing, water, electricity, gas, and fuel sector was also down 2.7%, due to a 3.9% fall in housing rents.

Inflation rate in the April of 2018 and 2021

The inflation rate in April was recorded to be 2.5%. Inflation eased to 2.5% in April from 2.9% in March. Meanwhile, the annual average variation in consumer prices rose from zero in March to 0.3% in April, the highest level in ten months.

Whereas the inflation rate in April for the year 2021 was declared to be 5.3%. There's a large gap between the inflation of April in 2018 and 2021 this is because the VAT increased from 5% to 15% in the year 2020. This caused the inflation rate to shoot. The depressed activity during the pandemic also caused the inflation to be particularly higher when the activities of the country were working a balanced and so the inflation rate was particularly stable.

Inflation rate in the May of 2018 and 2021

The inflation rate recorded in May of the year 2018 was 2.4% the inflation rate decreased by 0.1% following the previous month. Consumer prices dropped 0.4% from the previous month in May, falling from April’s 0.1% decrease. The drop largely reflected lower prices for housing, water, electricity, and gas; clothing and footwear; and food. No category posted higher prices in May.

However, the inflation rate in the year 2021 for the month of may was recorded to be 5.7%. The increase of 0.4% in the inflation rate was mainly due to higher prices of food and beverages and transport. Food prices weigh 17% of the Saudi consumer basket, making them the main driver of the headline inflation rate in May. The increase in inflation rate in 2021 indifference to the inflation rate of 2018 is mainly due to the presence of VAT in 2021 and its absence in 2018.

Inflation rate in the June of 2018 and 2021

The inflation rate June in 2018 was recorded to be 2.3% with a decrease of 0.1% from the previous month. However, this shows the stability of the country and none of the prices in the basket had significantly increased in the month of 2018.

The inflation rate in 2021 was recorded to be 6.2% with a very significant rise in the inflation rate following the previous year. With an increase in the transport prices, there was also a significant increase in the prices of the fuel and transport having great importance in the consumer basket increasing the inflation rate highly.

Inflation rate in the July of 2018 and 2021

The inflation rate July in 2018 was recorded to be 2.3%. it was one of the lowest inflation rates to be recorded in the year 2018. However, prices remained stable in July in all the units of the consumer basket.

The inflation rate of July 2021 was recorded to be 0.4%. In July, inflation dipped to 0.4% from 6.2% in June. The stark fall in inflation was due to the fading impact of the value-added tax rate, which increased from 5% to 15% back in July 2020. Meanwhile, annual average inflation decreased to 5.2% in July, down from 5.7% in the previous month. However, the economy of the Kingdom of Saudi Arabia stabilized significantly.

Inflation rate in the August of 2018 and 2021

The inflation rate in August 2018 was recorded to be 2.3%. The stable prices of the consumer goods in August kept the inflation rate to stay the same for consecutive three months.

The inflation rate in the year 2021 the month of August was 0.3%. In August, inflation ticked down to 0.3% from 0.4% in July. Subdued inflation was due to the fading impact of the value-added tax rate, which increased from 5% to 15% back in July 2020. The situation of pandemics started to ease this month largely hence causing the inflation rate to also drop.

Inflation rate in the September of 2018 and 2021

The inflation rate September in 2018 was recorded to be 2.1%. the inflation rate decreased by a few points from the previous months.

The inflation rate of 2021 in September was however 0.6%. The moderation in inflationary pressures reflects several factors, including a stronger US dollar (against which the riyal is fixed), lower international commodity prices, and a further easing of pandemic-related disruption to global supply chains.

Inflation rate on the October of 2019 and 2021

The inflation rate in October 2018 was recorded to be 2.1% as it is recorded to be the same as that of the previous month. The economy in the month of august is relatively more stable.

The inflation rate for October 2021 was 0.8%. Inflationary pressures were driven by higher prices of the food and beverages index and costlier transport which increased by 1.4 percent and 6.4 percent respectively. These two groups have the highest weighting in the index, at 19 and 13 percent respectively.

Inflation rate in the November of 2018 and 2021

The inflation rate in November 2018 was 2.6%. In November, inflation climbed from 2.4% in October to 2.8%, marking the highest reading in eight months. The increase in the inflation rate was due to the cost-of-living index levelling up to 106.5 points in November.

The inflation rate in November 2021 was recorded to be 1.1%. In November, inflation rose to 1.1% from 0.8% in October. Inflation remains relatively low due to the fading impact of the value-added tax rate, which increased from 5% to 15% back in July 2020. Meanwhile, annual average inflation decreased from 3.8% in October, to 3.4% in November. According to the inflation rate in November 2018 and November 2021 there is a significant difference as the easing of the pandemic crisis has also caused the inflation rate to lower.

Inflation rate in the December of 2018 and 2021

The inflation rate in the year 2018 the month of December is 1.9%. There is a sudden decrease in the inflation rate in December compared to that of the previous month. This shows that inflation has decreased and the prices of consumer goods have not increased.

The inflation rate for the year 2021 in December is recorded to be 1.2% with an increase of 0.1% from the previous month.

Final Results

The above results show that The Saudi economy recovered in 2021 after a tough year of pandemic restrictions as vaccination campaigns rolled out in the Kingdom and across the world driving its key oil exports. MENA’s largest economy bounced back from last year, when the Kingdom’s gross domestic product contracted by 4.1 percent, according to the International Monetary Fund. It saw higher oil output, its first quarterly budget surplus in over two years, and lower unemployment drove growth. Some economic data in 2021 even bettered pre-pandemic levels, although the full effect of the latest omicron variant is yet to be played out. However, the inflation rate in 2018 shows a stable rate of inflation across the year with slight differences. The inflation rate of Saudi Arabia was in its best form in the year 2018.

Cause of inflation in Saudia Arabia

- Saudi Arabia's GDP in 2013 become $745 billion, making it the nineteenth largest economic system in the international. At the identical time as searching on the breakdown of GDP, we find out that almost 1/2 is inside the oil region. Of the opportunity 1/2 of (non-oil), 70% is produced by using way of the private region, and 30% is produced through the government area. And due to the reality, the oil vicinity is owned and operated with the useful resource of the authorities, the surrender stop result is that 65% of Saudi Arabia's GDP is produced with the useful beneficial aid of the presidency or government-owned institutions.

- In 2009 own family intake jumped to 36.8%. that is due to the fact exports in that year dropped dramatically because of the credit score rating disaster. In 2012 family consumption grew 22%, the most it had grown in 10 years. This delivered on an immoderate name for some items, explaining some of the inflation, despite the reality that inflation that year became 2.9%, almost half of of of the decision of the one year earlier than. This indicates that the connection between family intake and inflation is not strong, or at least the facts are not regular and do not display a strong correlation. In precept, more consumption needs to bring about a better name for that could purpose inflation.

- Due to the fact 2010, authorities spending has been developing into the double digits. In 2010 the boom ended at 12%; in 2011 growth changed to 22%; and in 2012 and 2013 boom has become eleven% and 14%, respectively. A large part of this accelerated spending came within the form of gives, as an instance, government housing delivers fee variety and unemployment blessings like hafiz prices. some high-quality massive part of government spending went to infrastructure duties just like the present-day corporation and financial towns, which may be new towns constructed near important towns to attract network and foreign places funding inside the regions of producing

Recommendation

The satisfactory way to reduce inflation is that if the Federal Reserve were to offer excessive sufficient hobby expenses, extra calls can be reduced enough to prevent inflation without forcing the monetary system into an unnecessary recession.

Post a comment